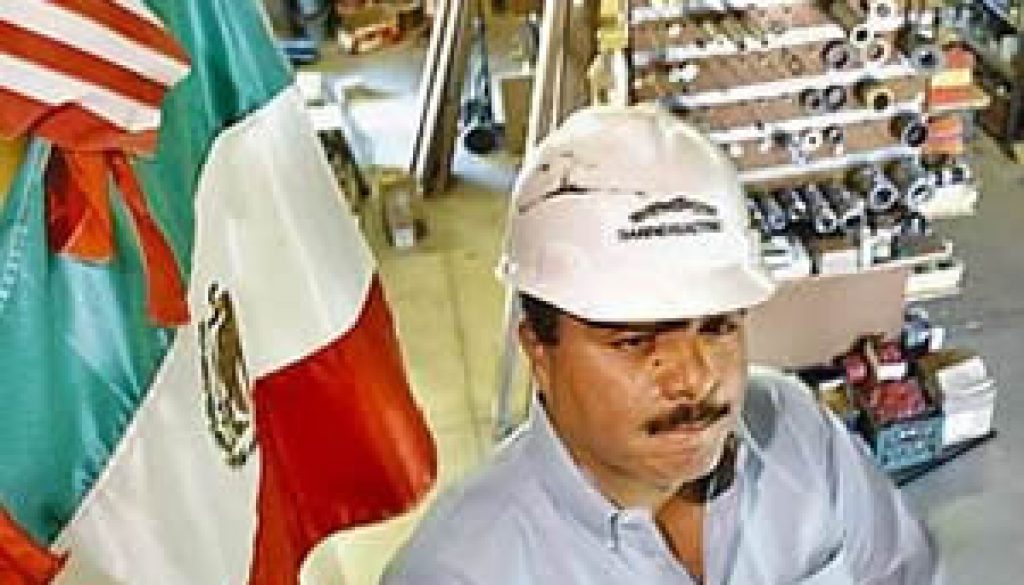

Effects of the tax reform on Mexico Maquiladora plants

By Adina Moloman

By Adina Moloman

Sources: Reuters, San Diego Red, Deloitte

Mexico’s Senate gave general approval to the tax reform that seeks to raise tax revenue by nearly 3 percent of GDP by 2018. According to the government the extra cash will go to infrastructure and social security.

A section of this tax reform is a tax increase on junk food (products that contain more than 275 calories per 100 grams) and soft drinks from 5 percent to 8 percent.

The income tax rate for those earning more than 750,000 pesos (around $60,000) is to go up as high as 35%.

It also become law a raise of the value-added tax (VAT) rate for states on the U.S. border to 16 percent from 11 percent like it is in the rest of the republic.

Deloitte presented through the Otay Mesa Chamber of Commerce a web seminar to transnational corporations manufacturing in Mexico which are operating as Mexico Maquiladora plants, dedicated to the most important effects the tax reform has on them. The tax reform mentions that all transactions with manufacturers or between foreign companies shouldn’t be VAT exempt. The government idea is to raise the activity of local, Mexican suppliers and have fewer imports in the country. Even when the intentions are good, there is hard to find Mexican suppliers for different complex industries.

According to Deloitte the reform will also force a foreign transnational company to become a Mexico Corporation after working 3 years as manufacturer. A transnational corporation in order to maintain it registered as manufacturer in Mexico will need to export at least 90% of what is producing.

Those transnational corporations manufacturing in Mexico can request a VAT refund for the costs they will incur on products such as materials, machinery and equipment.

Other measure of this tax reform involves a capital gains tax on stock market transactions and dividends. The government is considering a 10% tax on dividends (profits) of manufacturing companies. According to Deloitte all incentives will be eliminated so that the earnings made by Mexican and foreign companies stay inside the country.

Critics say these measures will affect Mexico’s economic growth.